Step 5: Submit File(s) to the IRS FIRE website

To upload your submission, file you'll need to access the IRS FIRE Website. For more information see the section above About the IRS Fire System.

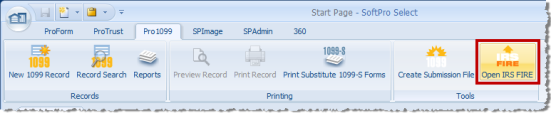

- From the Pro1099 ribbon, click the Open IRS FIRE button.

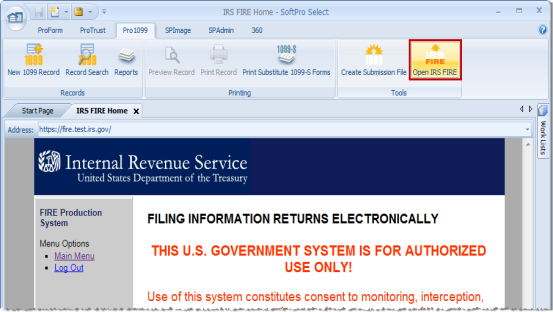

- The FIRE site appears within the Select application.

What is a replacement file?

Replacement files are not the same as corrected returns. A replacement file is an information return file sent by the filer because the CHECK FILE STATUS option on the FIRE System indicated the file was bad. A replacement file:

- may be required for bad originals OR bad correction files. If it is a bad correction file, it is created in Pro1099 as a correction and uploaded to the IRS as a replacement file.

- must be submitted within 60 days from the day the original file was transmitted.

How does one submit a replacement file?

Replacement files are submitted in the same exact manner as original submissions. After the necessary changes have been made, the file must be transmitted through the FIRE System. The IRS website automatically codes your submission as a Replacement. Filers should never transmit anything to IRS/ECC-MTB as a Replacement file unless the CHECK FILE STATUS option on the FIRE System indicates the file is bad.

How does one create a replacement file?

To create a replacement file, follow the same steps used to create an original submission with Pro1099. Read the remaining warnings and follow all instructions until the replacement file has been created.