Step 2: 1099-S Exceptions Report

Run the 1099-S Exceptions Report from Pro1099. The report will list the records which need to be corrected (i.e., missing Social Security Number, partial address, legal description, gross proceeds, etc.). When the report runs with no errors, you are ready to create your IRS Submission file. This report lists all non-exempt Pro1099 records that contain one or more exceptions for the tax year specified in reports criteria.

This process will likely be the most time consuming part of the 1099 Submission process. Success in accurately identifying and resolving exceptions will reduce the risk of needing to file a corrected return.

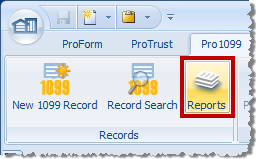

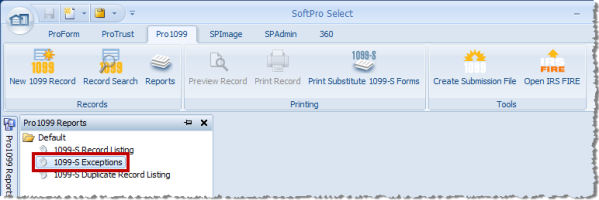

- Click the Reports button under the Pro1099 tab and then select the 1099-S Exceptions Report in the pane that appears at left:

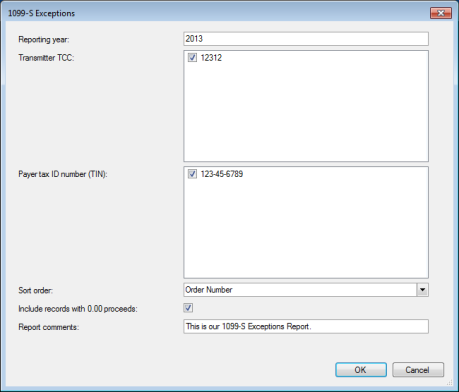

- Enter your report criteria on the 1099-S Exceptions report prompts/options dialog.

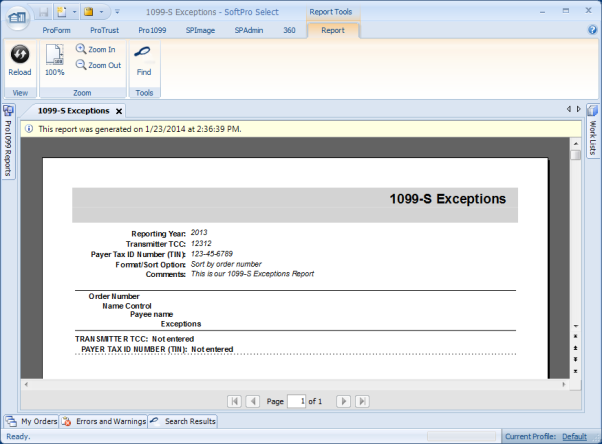

- Click OK to view the report.

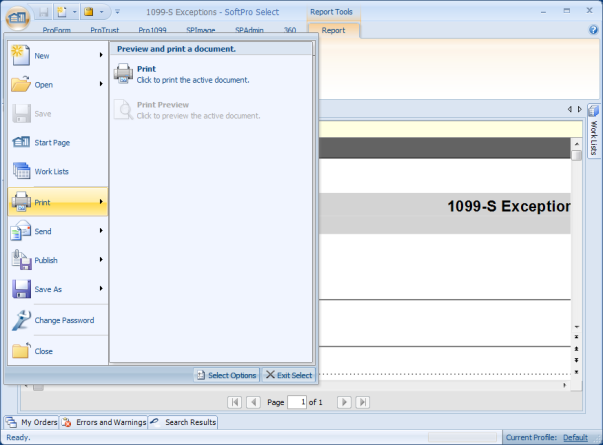

- To Print, click the Select button in the far upper left, and select that option from the menu. Other options are available to you as well.

- Note: you can preview the report by clicking Print Preview menu option.