Step 1: Application Configuration

Once you have obtained your TCC Code (see Preparing to Use the FIRE System), you can enter it into Pro1099 by following these steps:

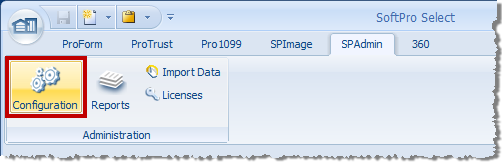

- Click on the SPAdmin tab in the ribbon, and then click the Configuration button:

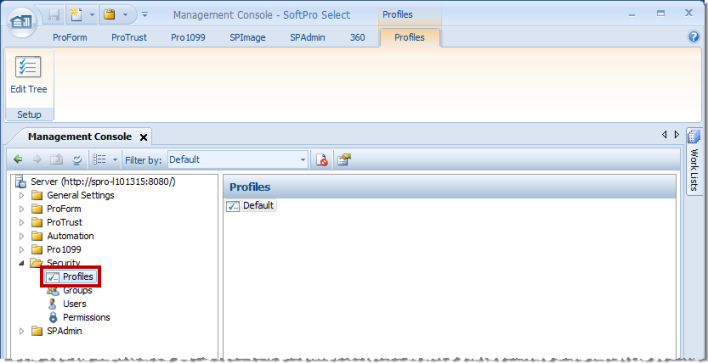

- Under the Security folder in the left pane, click Profiles, double-click the Profile in the right pane that will be used to prepare the 1099 submission, and then select the 1099 Tab on the dialog that appears.

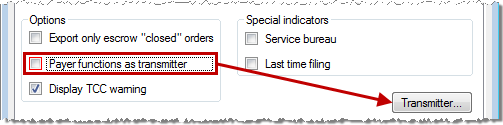

- Confirm and/or enter your Transmitter/Payer data (detailed below). The Transmitter button won’t be active unless your filing situation requires you to uncheck the Payer functions as transmitter checkbox. This checkbox is found under the Options area in the lower left.

- Click OK.

Payer information

- Payer Name: Enter the name of the payer whose TIN appears in positions 12-20 of the “A” Record. Extraneous information must be deleted. Filers shouldn’t enter a transfer agent’s name in this field. Any transfer agent’s name should appear in the Second Payer Name Line Field.

- Name Control: The Payer Name Control can be obtained only from the mail label on the Package 1099 that is mailed to most payers in December. Package 1099 contains Form 7018-C, Order Blank for Forms, and the mail label on the package contains a four-character name control.

- If a Package 1099 has not been received, you can determine your name control using the following simple rules. For a business, use the first four significant characters of the business name. Disregard the word "the" when it is the first word of the name unless there are only two words in the name. A dash (-) and an ampersand (&) are the only acceptable characters. Names of less than four characters should be left-justified, filling the unused position with blanks.

- TCC: The TCC (Transmitter Control Code) is required by the IRS before a file can be submitted electronically via the IRS FIRE System. Pro1099 requires the TCC number to be entered on the Transmitter/Payer Information screen. The transmitter's other contact information is also required on this screen.

Options

- Payer functions as transmitter: Check if the payer is also the transmitter (Default Setting). When the box is un-checked, the transmitter information becomes available.

- Note: If the payer functions as the transmitter, then only the payer information section needs to be completed. Also, if submitting multiple TaxIDs under one TCC, it is recommended that a “Transmitter” be enter for each TaxID.

- Display TCC warning: Check to remind user that a required TCC has not been entered.

Export only escrow "closed" orders: Defaults to unchecked.

- Check to export saved ProForm orders to Pro1099 when the order is a purchase with at least one seller, the Exclude order from IRS submission option is unchecked and the escrow status is closed.

- Uncheck to export saved ProForm orders to Pro1099 when the order is a purchase with at least one seller, the Exclude order from IRS submission option is unchecked, the Settlement date is equal or prior to today's date and the order status or escrow status is not Hold, Duplicate or Canceled.

Special Indicators:

- Service Bureau: Check to indicate if an agency will produce or submit files for electronic filing.

- Last Time Filing: Check if this is the last year this payer name and TIN will file information returns electronically, or on paper; otherwise, enter a blank.

- Foreign Corporation: Check to indicate if the transmitter is a foreign entity.

Transmitter Information

- Transmitter Name: Enter the name of the transmitter in the manner in which it is used in normal business.

Transmitter and Payer Shared Fields

- Name Line 2: If more space is required for the name, use the Second Payee Name Line field. The use of the business name is optional in the Second Payee Name Line field. A dash (-) and an ampersand (&) are the only acceptable special characters for First & Second Payee Name lines.

- Tax ID Number: Enter the tax ID number (TIN - 9-digit EIN/SSN).

- Contact Name: Required. Enter the name of the person to be contacted if IRS/ECC-MTB encounters problems with the file or transmission.

- Phone Number: Required. Enter the telephone number of the person to contact regarding electronic files. Note: If the foreign checkbox is checked, the field's format changes slightly to accommodate a foreign phone number (the area code parentheses and dash are removed, and the field extends to 20 characters).

- Phone Extension: Enter the extension of the person to contact regarding electronic files.

- E-mail Address: Required if available. Enter the E-mail address of the person to contact regarding electronic files. If no E-mail address is available, leave blank.

- Company Name: Required. Enter the name of the company to be associated with the address where correspondence should be sent.

- Name Line 2: Enter any additional information that may be part of the name of the company where correspondence should be sent.

- Mailing Address: Required. Enter the mailing address where correspondence should be sent.

- City: Required. Enter the city, town, or post office where correspondence should be sent.

- State: Required. Enter the valid U.S. Postal Service state abbreviation.

- ZIP: Required. Enter the valid nine-digit ZIP assigned by the U.S. Postal Service.

- Foreign: Check if this is a foreign address.

- Foreign address (text box): Enter the foreign address. Check Foreign checkbox & the address.