SoftPro Select 4.1 (4.1.40401.8) - 4/16/2016 - Part 2 of 4

Title Insurance

The Additional Title Charges screen has been modified, the Title Overlay process has been improved, Lien release recording information fields have been added to the Existing Liens, and entering title premiums has been improved on the Title Insurance Premium screen and related screens.

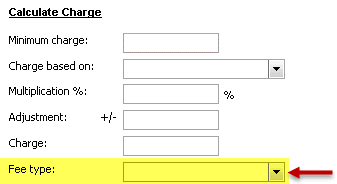

Additional Title Charges

- A Fee type drop-down field has been added in the Calculate Charge section. When a fee type is selected here, the fee type will be sent to the selected CDF line: 306862

- A change was made to allow users to send Additional Title Charges to lines 1101-1108 on 1986 HUD orders. 308236, 298615

Fee Types

- CDF fee types default as follows when sent from the Premiums & Endorsements screens. 281190

- Loan policies: Title Lenders Coverage Premium.

- Owner's policies: Title Owners Coverage Premium.

- Endorsements (all): Title Endorsement Fee.

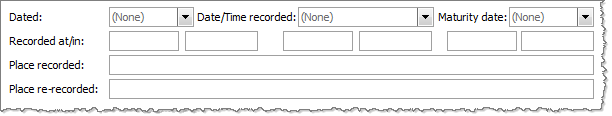

Existing Liens

- A new set of fields has been added to the Existing Liens screen. The Lien Release Recording Information contains the same fields that are included in the Recording Information section and they function in the same manner: 280134

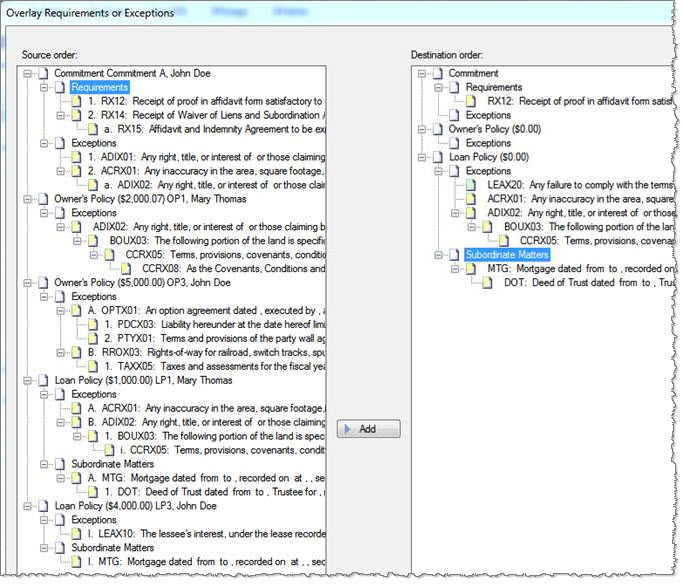

Title Overlay

- When overlaying title product items, the user may now drag and drop (or press Add) to include the following from the source order tree to the destination order tree: 64903, 13646

- individual items,

- multiple items,

- all items related to a commitment by selecting the Commitment node,

- all items related to requirements by selecting the Requirements node,

- all items related to exceptions by selecting the Exceptions node,

- all items related to owner’s policy by selecting the Owner’s Policy node,

- all items related to loan policy by selecting the Loan Policy node,

- all items related to subordinate matters by selecting the Subordinate Matters node.

Premiums

Several changes have been made to how title insurance premiums are handled.

Splits

- CDF Regulations: Recent federal regulations require that title insurance premiums be disclosed on the Closing Disclosure form in a specific way for simultaneous issues:

- The loan policy premium amount must reflect what the premium would be if it were not a simultaneous issue.

- The owner’s policy premium must reflect the difference between that loan policy premium and the total cost of the two policies under a simultaneous issue.

- Select version 4.0: With this previous release of the software, the regulated premiums were reflected in the CDF lines, payor/payee grids, and register.

- Select version 4.1: With this current release, we made a change to show the traditional premiums on the CDF payor/payee grids and in the register so that all disbursements and revenue reports reflect the final premiums.

- With CDF Simultaneous Issue policies, when the Show full premium on CDF/HUD-1 checkbox is checked, the final premiums will be sent to the payor/payee grids on the CDF lines instead of the SI net owner’s premium/Full loan premium.

- This will make tracking premiums and handling accounting easier, as the premiums in these areas will be the real premiums instead of the CFPB-regulated premiums.

- The SI net owner’s premium and the Full loan premium, however, are still shown on the CDF line for purposes of the regulatory requirements of the CDF document.

- Since there is no longer a need for the SI Net Owner’s premium and the Full Loan premium splits, they were removed.

Title Insurance Premiums & CDF Page 2

These changes only apply to 4.1 CDF orders and templates for Simultaneous policies when the “Show full premium on CDF/HUD-1” checkbox is checked; CDF orders and templates created in previous versions will still show the splits sections containing the previous field configurations.

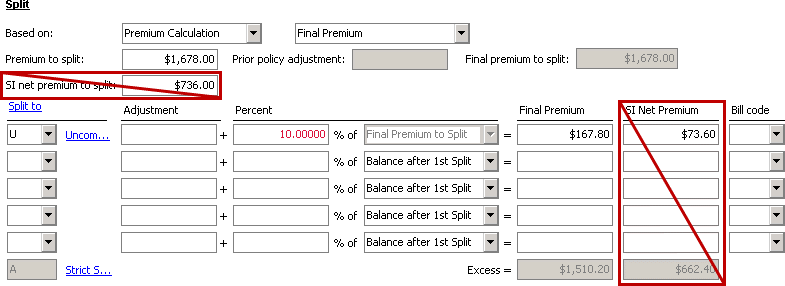

- The SI net premium to split field & SI Net Premium column have been removed from the Owner’s policy. The Final Premiums are now sent to the CDF payee/payor grids & register:

- The Full Premium to split field & Full Premium column have been removed from the loan policy. The Final Premiums are now sent to the CDF payee/payor grids & register:

- Payors/Payees grids: The CDF Payors and Payee grids now reflect the final premium amounts, not the CDF-disclosed amounts.

- A new Disclosures dialog was added: This dialog provides a view into both the owner’s and loan policy premiums, including the traditional amounts and the CFPB regulated amounts, seller pay percentage and amounts, paid by buyer, seller, and other amounts, and POC amounts.

- See examples below.

Title Insurance Premiums Disclosures Dialog

This new dialog provides a view into the title premiums as they will appear on the CDF lines and settlement statements, including line details on CDF page two, three, and the Register.

- The disclosures dialog shows both the loan and owner’s final and full premiums as they appear on the Title Insurance Premiums screen. The premiums can be edited on this dialog if Paid Before Closing, Paid by Others, or Paid by the Seller.

- It is not necessary for users to enter/alter information in this dialog.

- The dialog is available on CDF orders when the Show full premium on CDF/HUD-1 option is checked on the Title Insurance Premiums screen.

- This dialog does not write back to the Title Insurance Premiums (TIPS) screen. The general flow of data proceeds from the Title Insurance Premiums screen » Disclosure Dialog » CDF screens.

- The Seller % is one exception; it will write back to the Title Insurance Premiums screen.

- Another exception is that editing amounts on the CDF charges will always write back to the Disclosure dialog’s CDF fields.

- Note that you may always press the F2 key to reset the disclosure dialog fields with data from the Title Insurance Premiums screen.

Disclosures Dialog Details

The data entered for the basic title order example below will appear in the dialog as shown below.

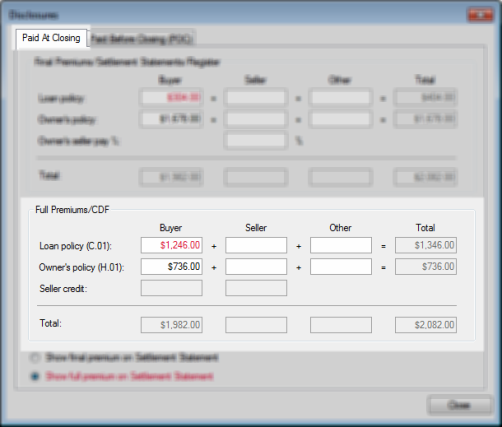

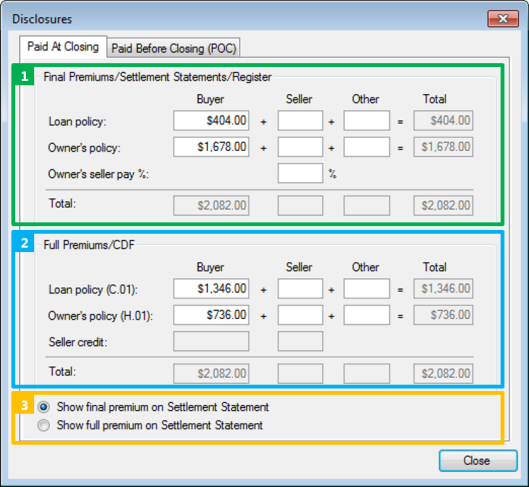

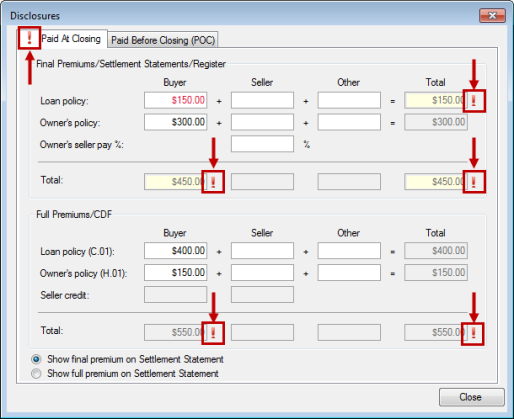

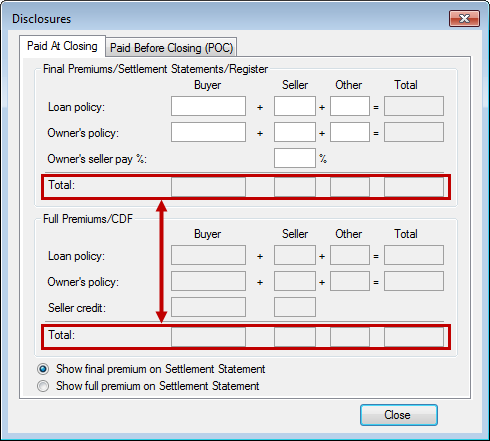

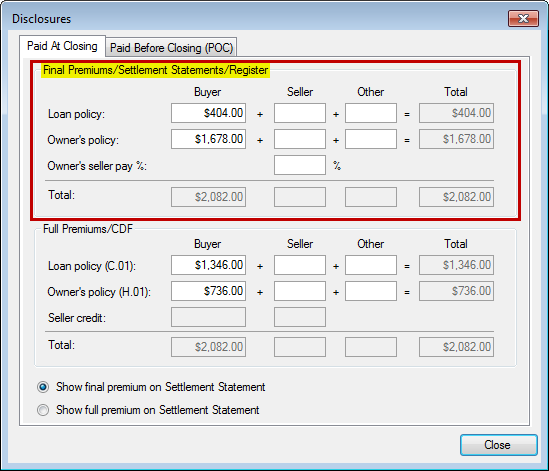

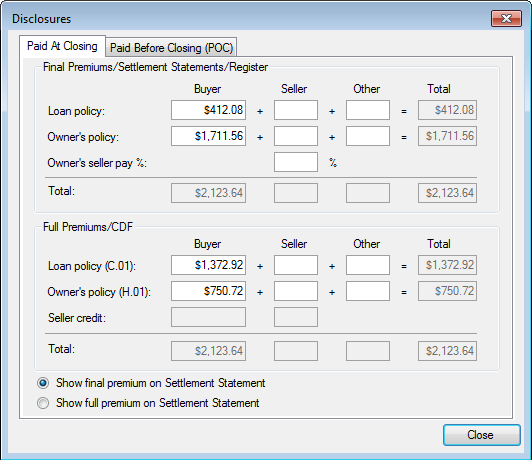

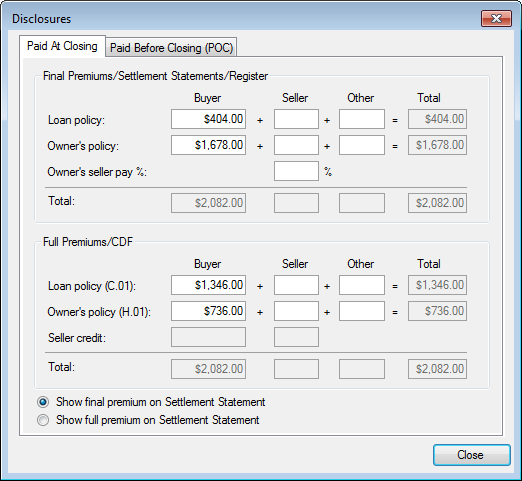

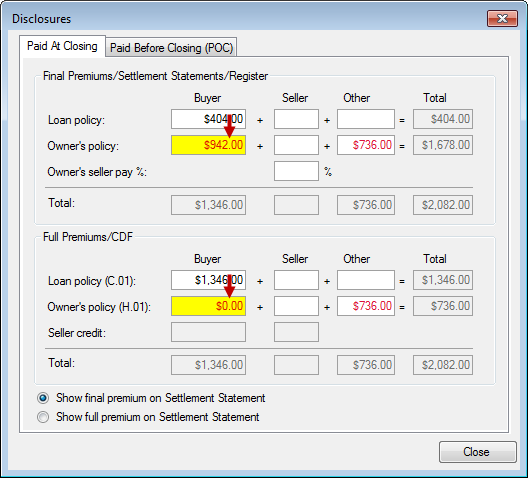

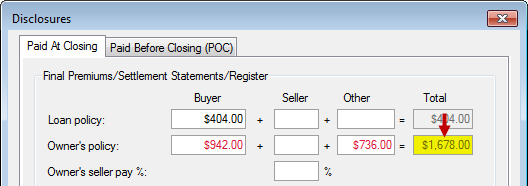

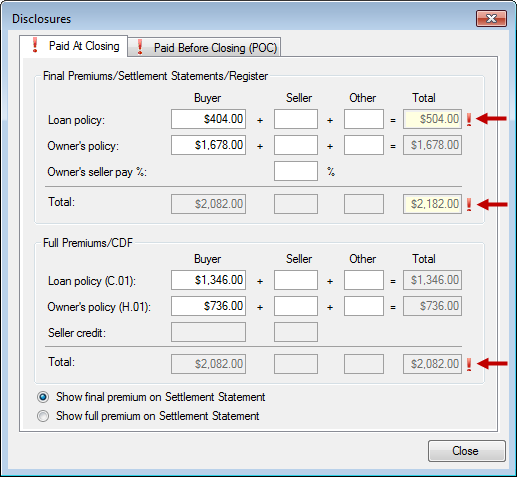

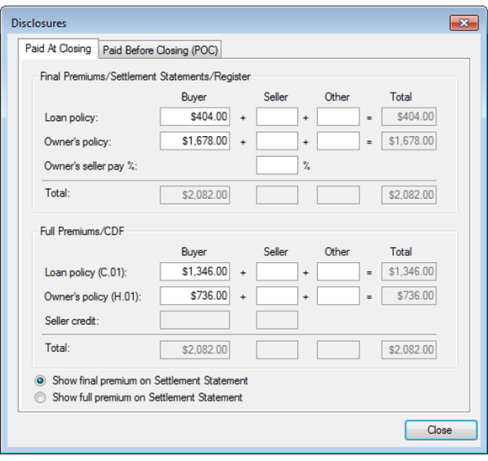

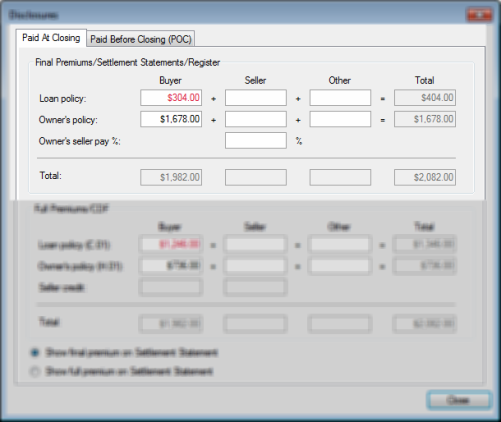

- Paid at Closing: This tab provides a breakdown of the Final Premium/Settlement Statements/Register amounts as well as Full Premium/CDF amounts:

- Final Premiums / Settlement Statements / Register: This section reflects the data that will flow into the settlement statement & Payor grids on the CDF as well as the register.

- Full Premiums / CDF: This data flows into the CDF lines/charges; changing this information on the CDF will also flow back into this dialog.

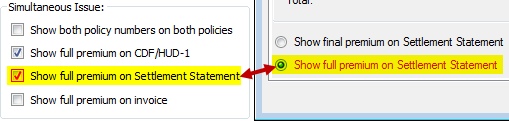

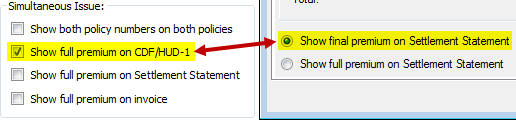

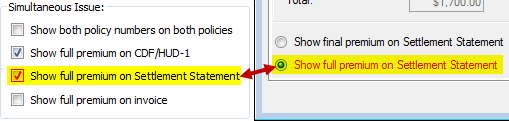

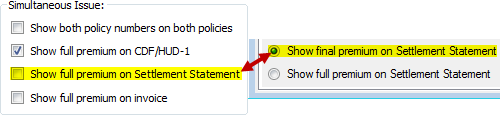

- The Show final premium on Settlement Statement and Show full premium on Settlement Statement options are related to the Simultaneous Issue checkboxes on the TIPS screen; these checkboxes/radio buttons stay in sync with one another.

- When the radio buttons are changed on the Disclosures dialog, the checkboxes on the Title Insurance Premiums screen will change, & vice versa.

- The radio buttons on the Disclosures dialog always tie to the Show full premium on Settlement Statement checkbox on the Title Insurance Premiums Screen.

- If unchecked, the top radio button is selected.

- If checked, the bottom radio button is selected.

- Here, the second radio button is selected on the Disclosures dialog, and the Title Insurance Premiums Screen checkbox synced automatically:

- These two items do not impact the Individual Buyer and Seller Statements; these documents will always print the final premiums.

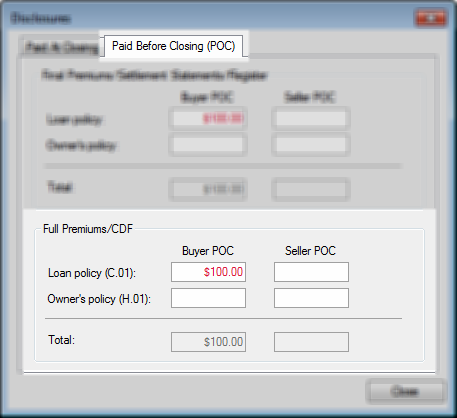

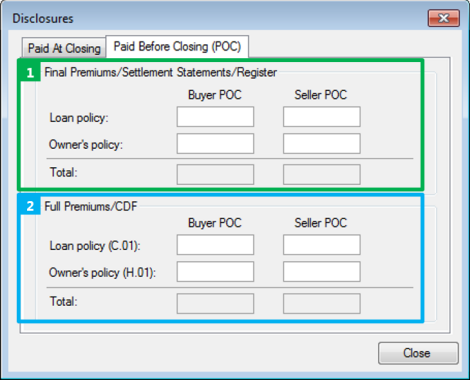

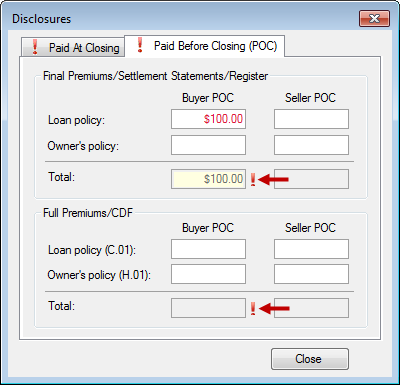

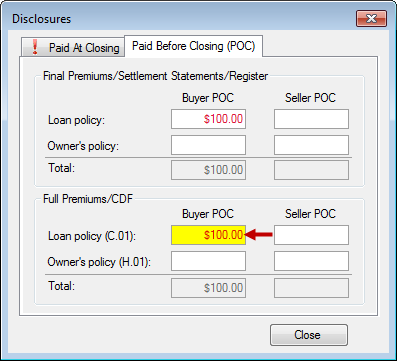

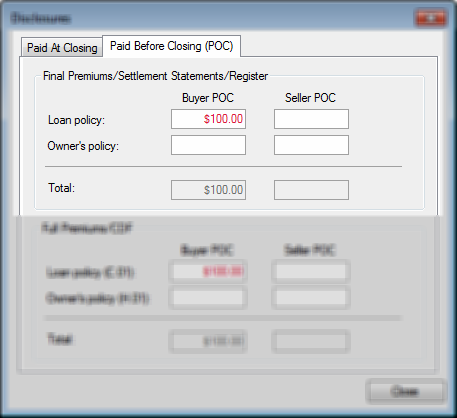

- Paid Before Closing (POC): This tab provides a breakdown of the Paid Before Closing (POC) Final Premium/Settlement Statements/Register amounts as well as Full Premium/CDF amounts:

- Final Premiums / Settlement Statements / Register: Any monies remitted outside of the closing by the buyer or seller may be input here and will flow into the payors grid under the related CDF charge.

- Full Premiums / CDF: Any monies remitted Outside of the Closing by the Buyer or Seller may be input here and will flow into the CDF line/charge.

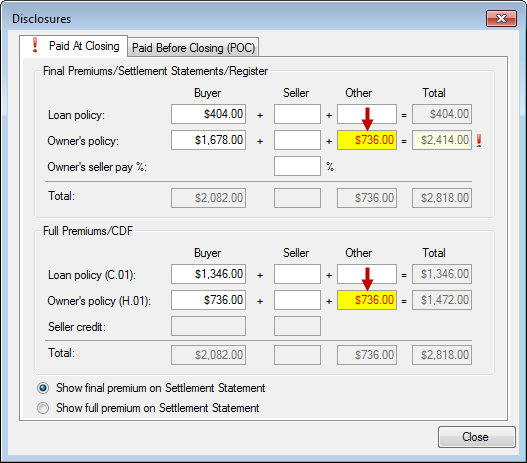

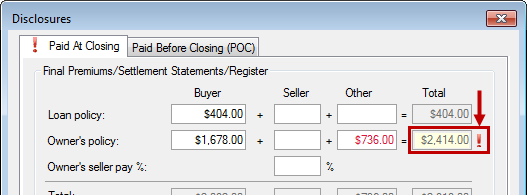

Validations: If amounts on this dialog are out of balance in some way, validation icons will appear in the tab(s) at the top of the dialog as well as next to each field that has a problem; problematic fields will also be shaded yellow:

- In order to remove these validation errors, adjustments must be made to ensure that the Total rows at the bottom of each section (Final Premiums/Full Premiums) match:

- The Total of the Loan Policy Final Premium much match the Final loan premium on the Title Insurance Premiums Screen.

- The Total of the Owners Policy Final Premium must match the Final owner’s premium on the Title Insurance Premiums Screen.

Dialog Access

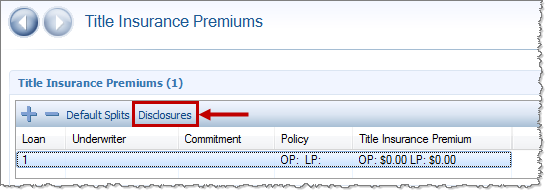

The dialog is accessible from several locations:

- Keyboard shortcut: Ctrl + Alt + D will display the Disclosures dialog.

- Title Insurance Premiums Screen: the Disclosures button at the top of the screen will pull up the dialog:

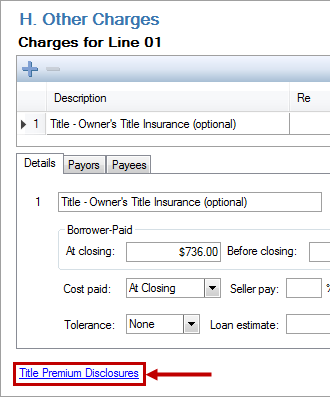

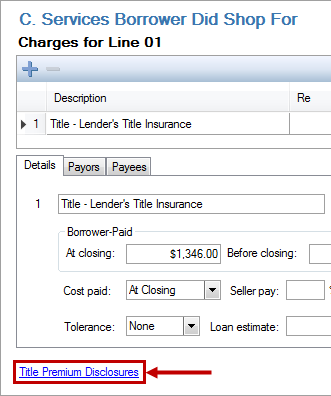

- Charge dialogs reflecting charges sent from the SI policy premiums:

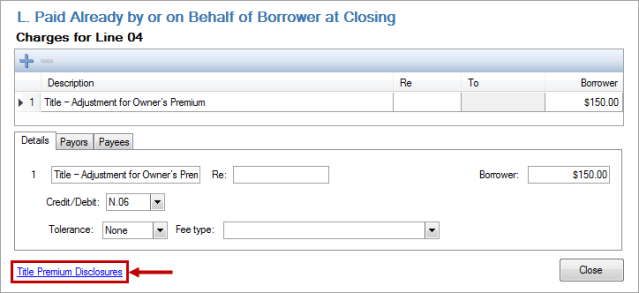

- Charge dialogs reflecting charges sent from the SI policy seller credit:

This example walks through a simple title policy to demonstrate the changes present in this release.

- Title Insurance Premiums Screen: a simple simultaneous issue policy was created.

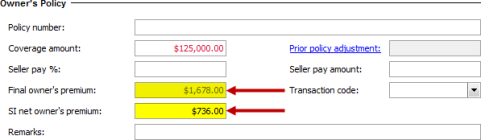

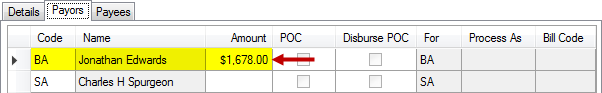

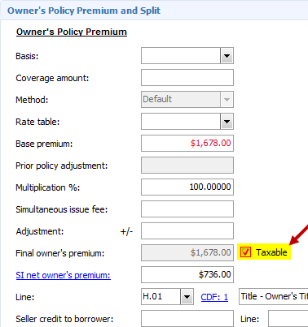

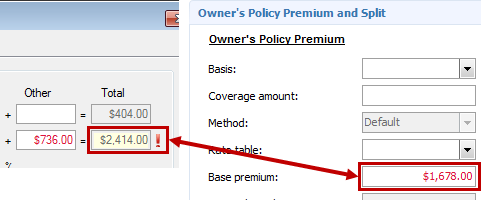

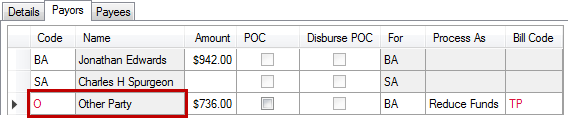

- Owner’s Policy: A final owner’s premium of $1,678 is present, along with a SI net owner’s premium of $736:

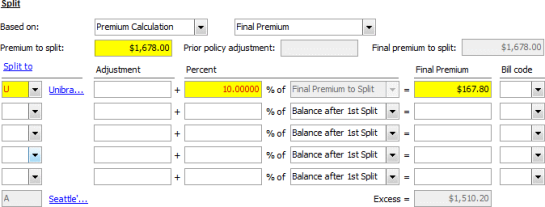

- Owner’s Policy Split: A 10% split is assigned to the underwriter:

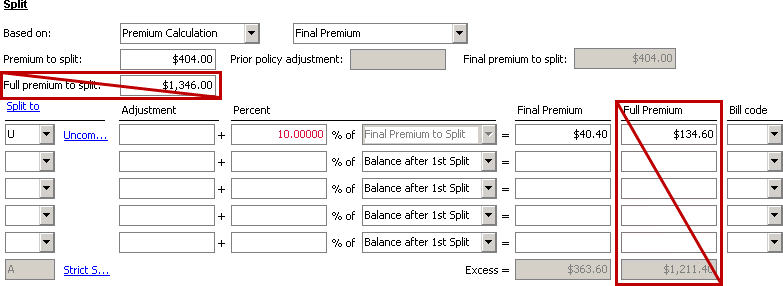

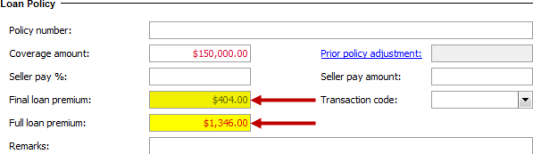

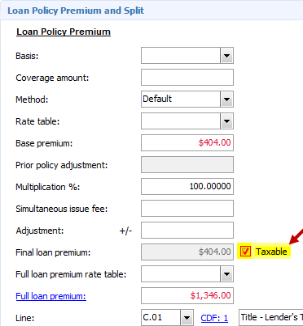

- Loan Policy: A $1,346 Full Loan Premium and Final Loan Premium of $404 are present:

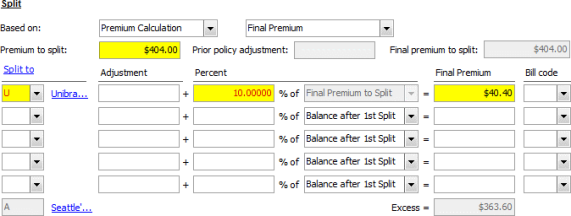

- Loan Policy Split: A 10% split is assigned to the underwriter:

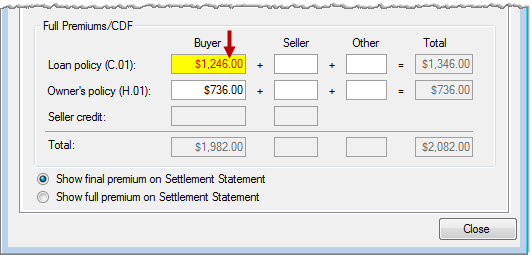

- CDF Page 2: Title premiums and splits now display a bit differently on the CDF screens. The manner in which amounts are sent to the CDF Screen amount columns—and likewise the CDF documents—is exactly the same as before; all that has changed are the payee/payor grids:

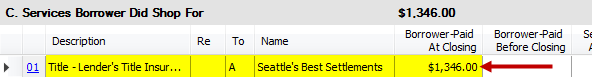

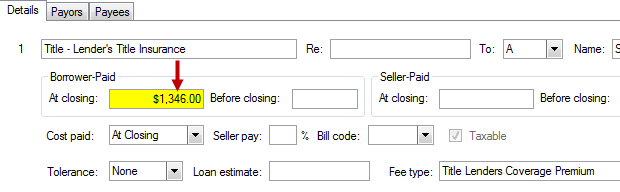

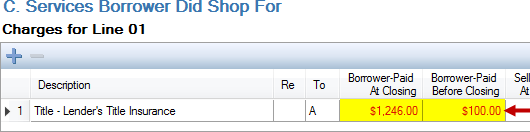

- Section C. Services Borrower Did Shop For: The Full Loan premium displays on the CDF line:

- Details Tab: The full loan premium also displays in the Details tab:

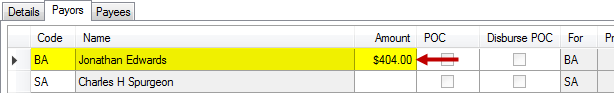

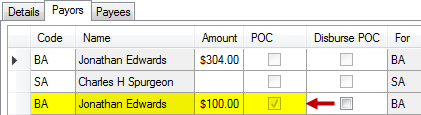

- Payors Grid: The final loan premium shows in the Payors grid:

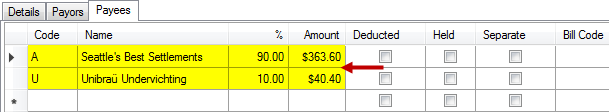

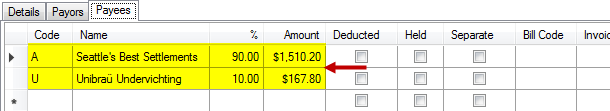

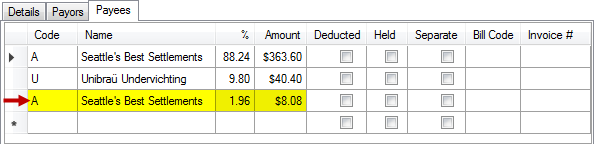

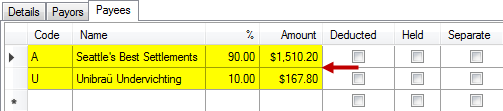

- Payees Grid: The 10% split is detailed in the Payees grid:

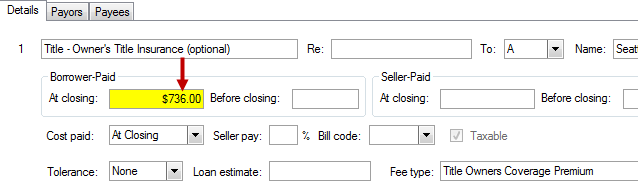

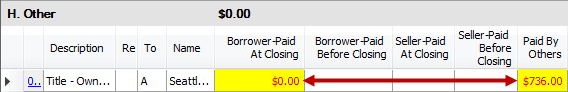

- Section H. Other: The SI net owner’s premium displays on the CDF line:

- § Details Tab: The SI net owner’s premium also displays in the grid:

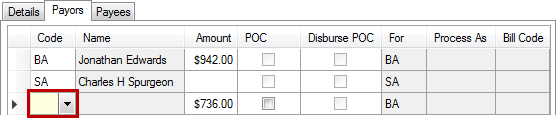

- § Payors Grid: The Final owner’s premium shows in the Payors grid:

- § Payees Grid: the 10% split is detailed in the Payees grid:

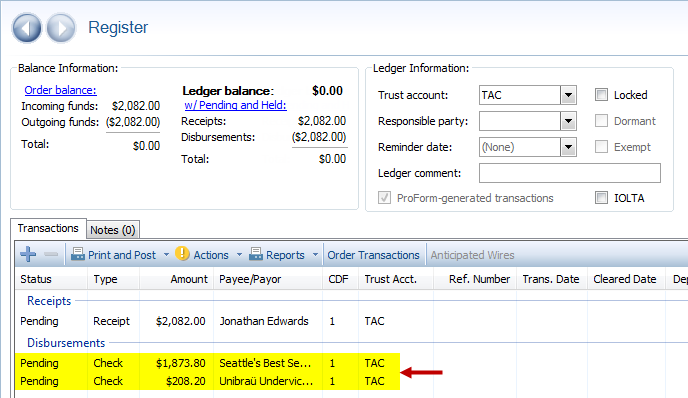

- Register: The two resulting checks to the Settlement Agent and Underwriter can be viewed under Transactions > Disbursements:

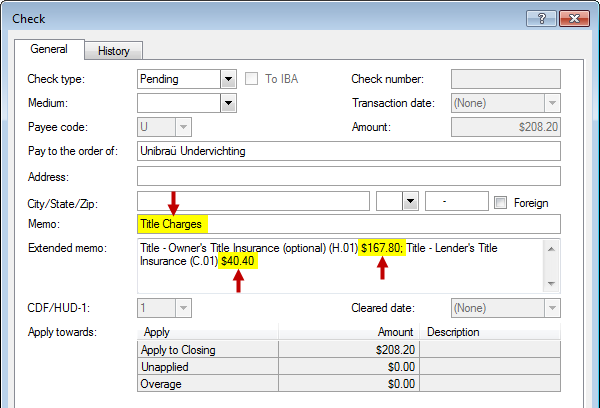

- Underwriter disbursement details: The 10% splits for the underwriter—$167.80 from the Owner’s policy and $40.40 from the Loan policy—are detailed in the Extended memo section with corresponding section numbers:

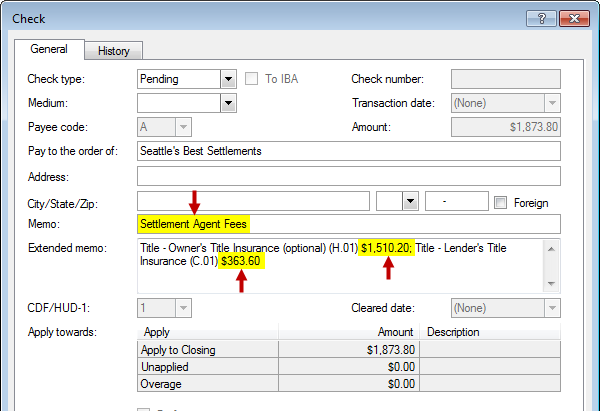

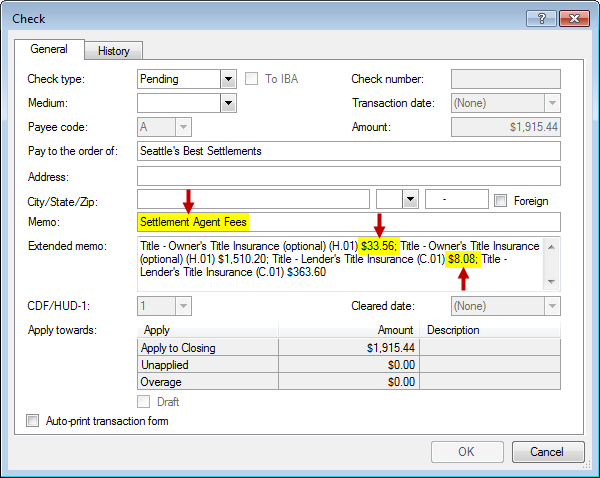

- Settlement Agent disbursement details: The 90% splits for the settlement agent—$1,510.20 from the Owner’s policy and $363.60 from the Loan policy—are detailed in the Extended memo section with corresponding section numbers:

- Disclosures Dialog: The disclosures dialog reflects the following amounts for the above disbursements:

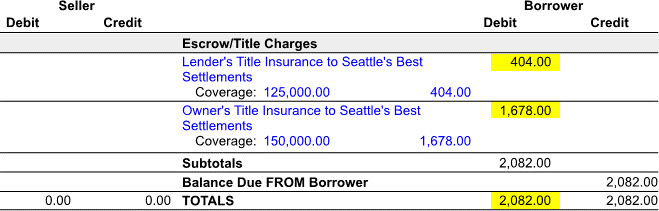

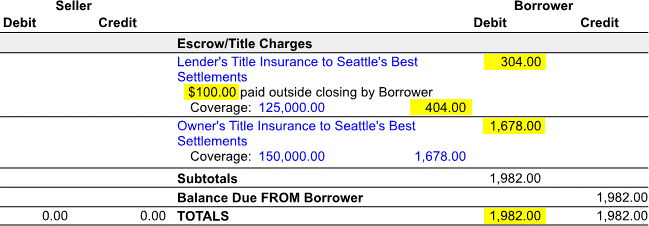

- Settlement Statement: The rendered master settlement statement here will reflect the final premium amounts:

‘

‘

Sales Tax and Policies

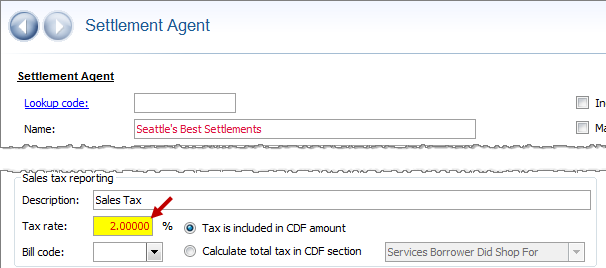

In this example the basic title order example above is used, with a few minor changes:

- Both the Loan & Owners policies are taxable.

- A 2% Tax rate has been added to the settlement agent:

- The Owner’s and Loan Policy Premiums have the taxable checkbox selected:

- The Disclosures dialog presents the following information, which includes tax amounts added to the premiums:

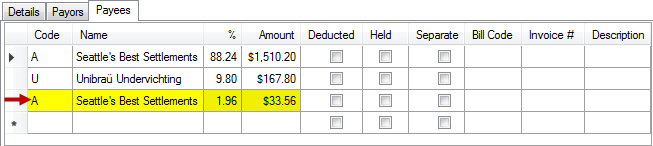

- The Payee grids automatically split out the tax amounts:

- Settlement Agent disbursement details: In addition to the 90% splits for the settlement agent—$1,510.20 from the Owner’s policy and $363.60 from the Loan policy—the tax amounts are also detailed in the Extended memo section with corresponding section numbers:

Seller Pay

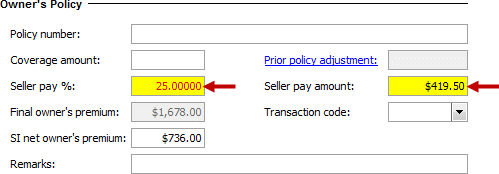

In this example the basic title order example is used, with one minor change:

- The Owner’s policy is paid 25% by the seller.

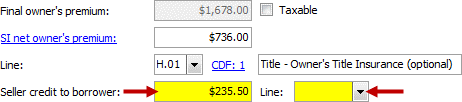

- A line is not selected for the Seller credit to borrower:

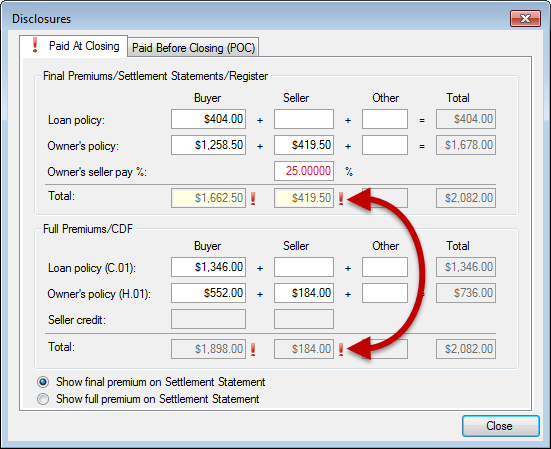

- This results in validations (warnings) appearing on the Disclosures dialog because the numbers are not in balance because a line has not been selected for the Seller credit to borrower:

- When the fields do not validate correctly, exclamation points will appear on the tab at top, as well as next to fields that are not properly in balance. Fields in question will also be shaded yellow.

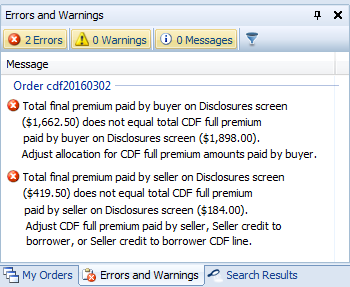

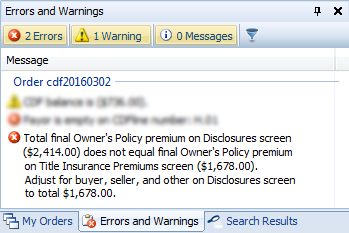

- Errors are also presented in the Errors and Warnings panel:

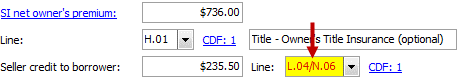

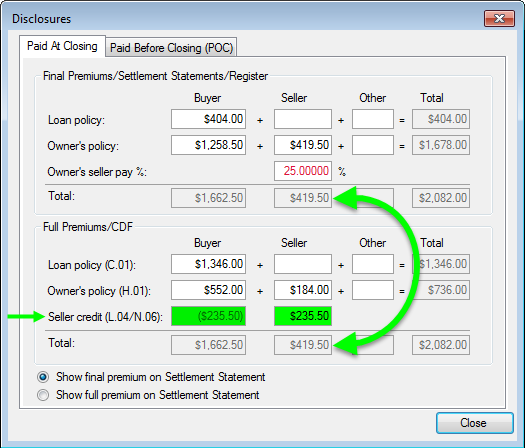

- Once a CDF line is selected for the Seller Credit to borrower, the Disclosures dialog is brought into balance and the validation warnings are removed:

- Note: There are other ways to fix this particular issue if you do not want to use a CDF Page 3 credit. You could manually edit the CDF Amount Columns to apply the rest of the $419.50 that the seller is paying.

Paid By Others

In this example, the basic title order example is repeated; the only difference here is that a third party is paying for the Owner’s Policy.

- Here is the basic title example; with all amounts balanced:

- Here, $736 is entered in the Other column for the owner’s policy fields:

- This validation warning appears, indicating that an adjustment needs to be made to compensate for the third party (Other) paying for the Owner’s policy:

- The total policy here is compared against the policy amount on TIPS

- This validation warning is also reflected in the Errors and Warnings panel:

- The error can be resolved by reducing the Owner’s policy amounts in the Buyer column by $736, thus reducing the amount the buyer is paying:

- This is how the Owner’s Policy now appears on the CDF line:

- On the Payors tab, enter the applicable code for the party paying for the Owner’s Policy:

- The entire Final Owner’s policy premium amount is always reflected on the Payee tab:

In this example, the basic title order example above is repeated, with the only difference being that the buyer has put money toward the Loan policy outside of closing and no tax was applied.

- Here’s the basic title example; with all amounts balanced:

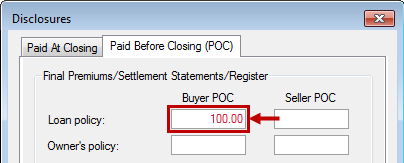

- $100 is input towards the Loan Policy Buyer POC field on the Paid Before Closing (POC) tab:

- As a result, several warnings appear:

- Paid Before Closing (POC) tab warnings:

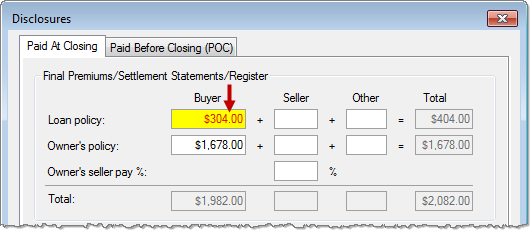

- Paid at Closing tab warnings:

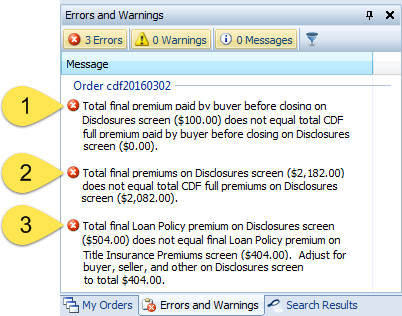

- Errors and Warnings panel: You may double-click these items; the corresponding tab on the Disclosures dialog will open for corrections:

- Explanations of these three warnings, as well as their resolutions, are as follows:

- The $100 for the Final Loan policy premium entered as a POC does not equal the Full Loan policy premium POC.

- $100 needs to be added to the Full Premium Loan policy because you must balance the final premium with the full premium:

- The total of the Final premiums on the Paid at Closing tab does not match the total CDF full premiums.

- Part of this error is resolved with bullet #3 below. However, you must reduce the Final premium Loan policy by $100:

- The Final Loan policy premium on the Paid at Closing tab doesn’t equal the final loan policy on the Title Insurance Premiums screen.

- Reduce the Loan policy full premium by $100 so that the total of the loan policy premium will now match the Title Insurance Premiums screen.

- The $100 for the Final Loan policy premium entered as a POC does not equal the Full Loan policy premium POC.

- The CDF Grid will display these amounts in the two columns shown here:

- The Payors grid for the Loan Policy Premium appear as follows:

Settlement Statements

The CDF Settlement Statements were updated show the Final Premiums instead of the Full Premiums inside the debit columns rather than as a note inside the description column. Individual Settlement Statements for orders created with v4.1 or higher will always disclose the final premium amounts in the center details column since these documents utilize the payor amounts to determine transactions. 300131

See the Paid Outside of Closing (POC) Example above to review the numbers given below.

Example One

If the Show final premium on Settlement Statement radio button is selected on the Disclosures dialog (the Show full premium on Settlement Statement checkbox on TIPS will be unchecked), the Settlement Statements will show the Final Premium fields in the Seller and Borrower columns, as well as in the center details column.

- Disclosure Dialog (Paid at Closing Tab & Paid Before Closing Tab): Note carefully the data reflected in the top half of the dialog:

- TIP screen checkbox/Disclosure Dialog options: Note that these two radio buttons are the same as the checkboxes on the Title Insurance Premium Screen; changing this option in TIP will change the Disclosure dialog, and vice versa:

- Rendered Master Settlement Statement:

- The total final premium paid by all parties shows in the details.

- The final premiums show in the Credit/Debit columns.

- The borrower is paying $100.00 of the Owner’s premium outside of closing.

- The $404.00 in the details column represents the Loan Policy’s Final Premium Total before the Paid Outside Closing (POC) amount have been applied.

- Note: If the Show final premium on settlement statement radio button is selected, the Seller credit amount will not print on the Settlement statements.

- When the final premiums are shown, there is no need for the seller credit to show; this is only needed when the full premiums show on the settlement statements.

Example Two

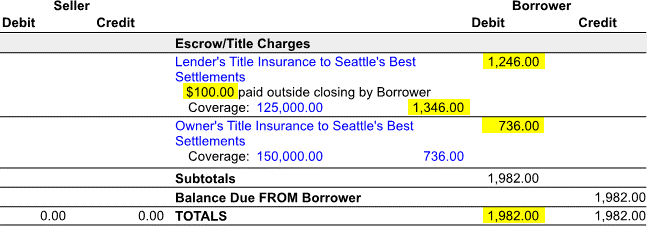

If the Show full premium on Settlement Statement radio button is selected on the Disclosures dialog AND the Show full premium on Settlement Statement checkbox on TIPS is checked, the Settlement Statements will show the Full Premium fields in the Seller and Borrower columns, as well as in the central details column.

- Note that these two radio buttons are the same as the checkboxes on the Title Insurance Premium Screen; changing this option in TIP will change the Disclosure dialog, and vice versa.

- Disclosure Dialog (Paid at Closing Tab & Paid Before Closing Tab): Note carefully the data reflected the bottom half of the dialog:

- TIP screen checkbox/Disclosure Dialog options: Note that these two radio buttons are the same as the checkboxes on the Title Insurance Premium Screen; changing this option in TIP will change the Disclosure dialog, and vice versa.

- Rendered Master Settlement Statement:

- The full premiums show in the Credit/Debit columns.

- The borrower is paying $100 of the Owner’s premium outside of closing.

- The $1,346,00 represents the Owner’s Policy Full Premium Total before the Paid Outside Closing (POC) amount has been applied.